How do banks calculate how much you can borrow

Skip the Bank Save. You and your partners annual income provides the baseline for calculating your mortgage affordability.

Credit Score Chart And How This Helps You Get The Lowest Interest Credit Score Chart What Is Credit Score Credit Score

Ad Comprehensive Customized Solutions To Help Achieve Your Organizations Financial Goals.

. At 5 your maximum mortgage is 149957 Maximum monthly payment PITI 99000 indicates required. We recommend seeking financial advice about your situation and goals before getting a financial product. How can I qualify for the maximum amount offered.

But ultimately its down to the individual lender to decide. This mortgage calculator will show how much you can afford. Combined amount of income the borrowers receive before taxes and other deductions in one year.

This calculator is for information purposes only and does not provide financial advice. Work out how much you earn. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

Get Instantly Matched with the Best Personal Loan Option for You. How long it will take to repay the mortgage in full. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your.

There are several income sources that banks will consider when calculating your overall income. Combined amount of income the borrowers receive before taxes and other deductions in one year. Estimate how much you can borrow for your home loan using our borrowing power calculator.

This figure is then multiplied by 80 or 85 percent or higher if the lender permits to determine your loan amount. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Youll also need to consider any repayments youre already making toward current debts.

Things like your deposit and credit rating will also be factors so remember our calculation is only a rough idea of what you could borrow. Your salary will have a big impact on the amount you can borrow for a mortgage. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and anyone you are buying with.

A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a property. To figure out much you can realistically afford to borrow youll need to take into account how much you actually need as well as your income and your ability to make repayments. Your financial future is established by making wise decisions with your money.

When you apply the lender will calculate the equity you have in your home by subtracting your homes value from the amount you owe. Click Now Apply Online. There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle.

Combined amount of income the borrowers receive before taxes and other deductions in one year. Enter a value between 0 and 5000000. This means if youre buying alone and earn 30000 a year you could be offered up to 135000.

But generally there are five key steps banks will take to assess how much you can afford to borrow. We are dedicated to helping. Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

With these easy-to-use calculators you can be better prepared to make. By using our free financial calculators you can evaluate your options for buying a home refinancing a mortgage consolidating loans paying off debt buying a new car and saving for retirement. Were Americas Largest Mortgage Lender.

Ad Were Americas Largest Mortgage Lender. Estimate how much you can borrow for your home loan using our borrowing power calculator. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You.

These are your monthly income usually salary and your monthly obligations credit card debts car payments etc. Commercial Banking Made Seamless With Union Bank Schedule A Call Today. The first step in buying a house is determining your budget.

If you buy a home for 400000 with 20 down then your principal loan balance is 320000. Ad Work with One of Our Specialists to Save You More Money Today. Banks set interest rates correspondingly to the rates set by the Federal Reserve.

The tool will immediately calculate your current loan-to-value ratio. There are exceptions to this however. To talk to one of our team at ANZ please call 0800 269 4663 or for more.

These four parts are principal interest taxes and insurance. As part of an affordability assessment lenders will check your credit. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a mortgage pre-approval.

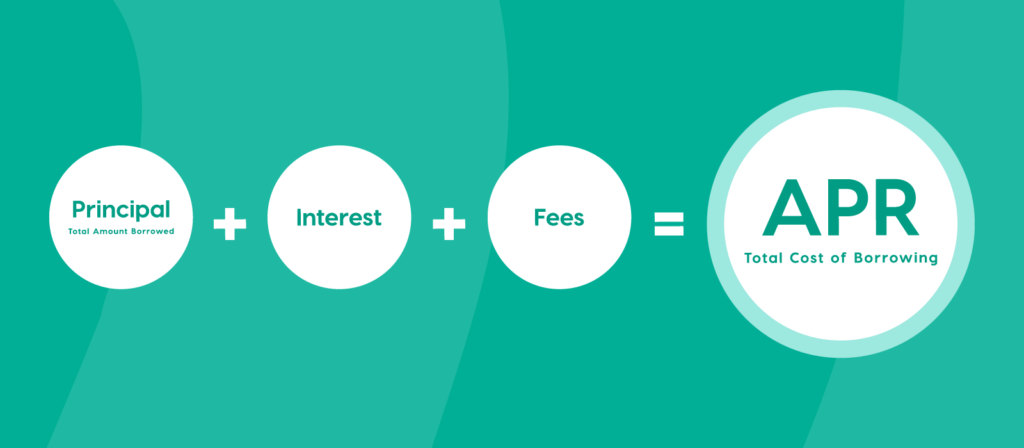

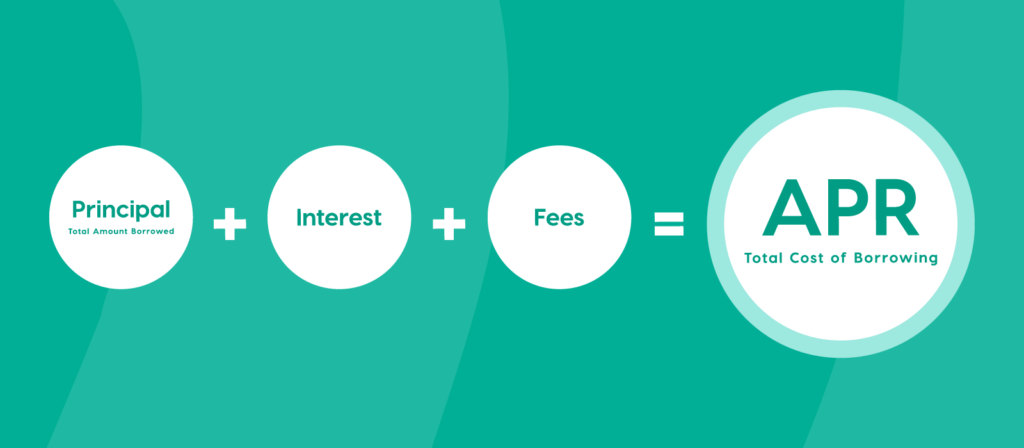

Ad Low Interest 2022 Top Lenders Bad Credit Bank Loans Comparison Reviews. The amount you owe without any interest added. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

For this reason our calculator uses your income too. Plan today for a better tomorrow. Your salary will have a.

Calculate how much I can borrow. Fill in the entry fields and click on the View Report button to see a. View your borrowing capacity and estimated home loan repayments.

The amount of interest youll pay to borrow the principal. When you apply the lender will calculate the equity you have in your home by subtracting your homes value from the amount you owe. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

If the same 320000 loan above has a 4 rate then youll pay. Or 4 times your joint income if youre applying for a mortgage with someone else although some. Its calculated based on your basic financial information such as your income and current debt.

ANZ Home Loans are subject to our lending criteria terms conditions and fees.

Learn The True Cost Of Borrowing Birchwood Credit

Use The Interactive Home Loan Calculator To Calculate Your Home Loan Emi Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Payment Calculator

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Borrowing Base What It Is How To Calculate It

What Are Interest Rates How Does Interest Work Credit Org

How To Calculate A Mortgage Payment Youtube

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)

How To Get A Loan From A Bank

Lvr Borrowing Capacity Calculator Interest Co Nz

6 Things To Do For Quick Approval Of Personal Loan Personal Loans Person Loan

Types Of Financial Statements Bookkeeping Business Learn Accounting Accounting Basics

Hard To Borrow Fee Calculation Ally

How To Calculate Loan Payments And Costs Nextadvisor With Time

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

Loan Calculator That Creates Date Accurate Payment Schedules

What Is A Personal Loan And How Does It Work In 2022 Personal Loans Financial Management Balance Transfer Credit Cards

How To Increase The Amount You Can Borrow My Simple Mortgage